Business/Corporate Toolkit Orientation

Tool 1

Take the Instant Payments Awareness Survey to understand the benefits of Instant Payments for Businesses / Corporates

Tool 2

Take the Instant Payments Adoption Maturity Self Assessment for Businesses / Corporates to understand current maturity and where you are in the adoption journey

Tool 3

Sign up for follow up discussions with Deloitte SMEs to discuss survey results, next steps, and get any additional queries answered

Instant Payments Awareness Survey is the First Step for Businesses / Corporates in their Awareness journey

Expected Outcome from the Survey1

Instructions on use:

Businesses / Corporates may take the short surveys to understand the benefits and opportunities that an organization can explore by adopting Instant Payments based on their payments mix and organization’s priorities:

Survey 1 – Instant Payments Awareness Survey: Inbound Payments (C2B)

Survey 2 – Instant Payments Awareness Survey: Outbound Payments (B2B or B2C)

- Click on the survey icons, below, to access the survey

- The survey consists of 5 questions that take less than 5 minutes to complete

- Please note that clicking ‘Calculate’ on the survey form will NOT lead to any information entered to be shared with Deloitte2, the FPC, or any other party

Note: 1) The benefits/opportunity areas are directional in nature and FIs may use the information at their own discretion; 2) FIs can choose to share the data with Deloitte if they plan to engage in a 1x1 deep dive session with Deloitte SMEs (Tool 3).

Access the Inbound Survey and the Outbound Survey for Businesses / Corporates here:

Input

Payment Mix

Range of payment volume for different payment methods e.g., checks, credit cards, ACH, Alternate Payment Methods, etc.

Organization Goal

Organization’s priorities such as payment processing cost reduction, superior customer service, risk reduction, revenue enhancement, etc.

Survey

Output

Opportunity Areas

Opportunity areas such as reduction in check processing cost, improvement in customer NPS, improvement in reconciliation processes, etc.

Instant Payments Adoption Maturity Self Assessment Tool helps Businesses / Corporates Benchmark Progress Against the Maturity Curve

Expected Outcome from the Tool

Instructions on use:

Businesses / Corporates may use this tool to assess their readiness to adopt Instant Payments. This tool helps them determine where they are in their current journey of adopting Instant Payments and identify next steps needed to gain further momentum

- Evaluate Business, Operational and Technology readiness dimensions by clicking on the spreadsheet below

- In the individual readiness tables for each dimension (tab 2, 3 and 4), select the status for the Readiness activities from the drop-down list based on your current completion status

- Use the graph present on tab 5 to benchmark the scores against the maturity model to determine organization’s position on the maturity curve and readiness to adopt Instant Payments

Instant Payments Adoption Maturity is Measured Across Three Readiness Dimensions

Strategic focus to adopt Instant Payments in line with an organization’s priorities and broader payments modernization vision

Capability to upgrade existing technology systems and standards pertaining to legacy infrastructure for Instant Payments adoption

Capability to efficiently deploy, operate and maintain the systems and procedures to implement Instant Payments within an organization

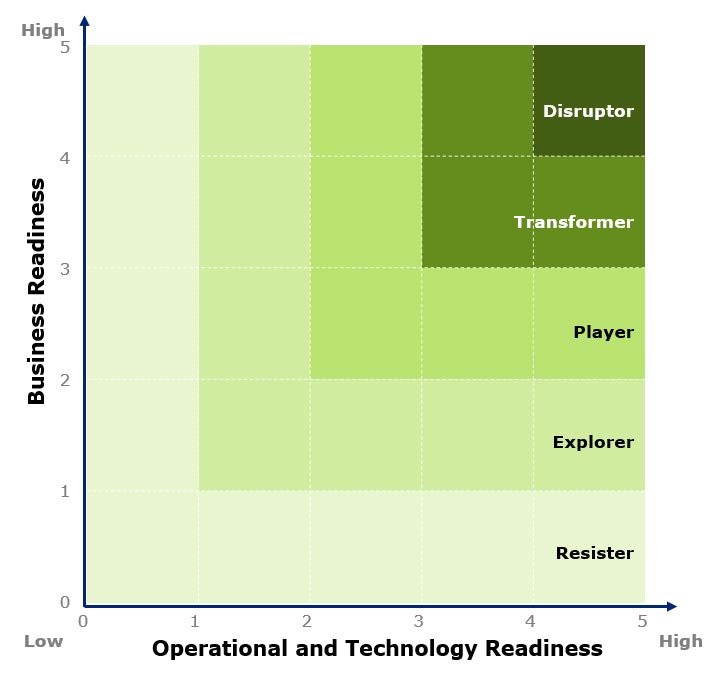

Based on the Scores across Business, Operational and Technology Readiness Dimensions, Businesses / Corporates can Determine their Position on the Maturity Curve

Characteristics

Disruptor

Businesses / Corporates for whom Instant Payments solution is a strategic need and hence have developed the capability to support multiple use cases, e.g., for both inbound and outbound payments applicable in B2B, B2C and C2B space.

NEXT STEPS:

- Identify additional growth opportunity areas in Instant Payments and strive for innovation to further the adoption for the benefit of the larger industry

- Leverage Instant Payments to build and offer value-added services to the customers

Transformer

Businesses / Corporates that have understood the strategic need for Instant Payments solution to keep pace with third party players offering Instant Payments services or to address rapidly changing customer needs.

NEXT STEPS:

- Define the roadmap for commercialization and launch Instant Payments for the selected use case to a wider customer base

- Build on the momentum by scaling up to include more use cases from the priority list or expanding to different customer segments and conduct supplementary pilots

Player

Businesses / Corporates that are beginning to recognize the importance of offering Instant Payments services and have started building the required operational and technological capabilities.

NEXT STEPS:

- Design a criteria to prioritize use cases (e.g., alignment with organization goals, investment required, resources needed, expected changes in internal processes), work with your banking partner to identify the most impactful use case, build a business case for Instant Payments and seek buy in from relevant stakeholders

- Outline the pre-requisites for faster payment adoption, chart out the implementation plan and sign up for a small-scale pilot with your banking partner

Explorer

Businesses / Corporates that have either not fully recognized the importance of Instant Payments for their retail/corporate customers yet or have limited capability/resources/funds or all.

NEXT STEPS:

- Identify a banking partner to chart out a roadmap and accelerate their effort towards implementing Instant Payments

- While choosing a banking partner, Businesses / Corporates may consider factors such as cost (implementation and ongoing maintenance cost, cost of additional services/modules), time to market, technical depth (core payment capabilities offered, alignment with global messaging protocols for Instant Payments, level of tech support offered, fraud and risk monitoring services), alignment with broader payments strategy and deployment options, and solution maturity (experience with Instant Payments, success stories), etc.

Resister

Businesses / Corporates that either don’t have the need (i.e., Instant Payments solution not requested by customers or no competitive pressure from third party players offering payments services to their customers) or the capability/resources to adopt Faster Payment solutions or both.

NEXT STEPS:

- Educate your internal stakeholders on the benefits to adopt Instant Payments and become a pioneer in your industry

- Identify the processes and systems that need to be updated to build operational and technical capability for a minimum viable product

Tool 3 for FIs and Businesses/Corporates:

Instant Payments Adoption Deep Dive Discussion with Deloitte

Financial Institutions and Businesses / Corporates can engage in a one-hour business consultation session with Deloitte to firm up the Instant Payments roadmap and get answers to any additional queries by SMEs

What to Expect?

Understand opportunity areas, potential use cases and focus areas to accelerate Instant Payments adoption

Participate in discussions with Deloitte SMEs to identify drivers influencing the industry adoption of Instant Payments

Develop a structured approach to move ahead in your Instant Payments journey, e.g., participate in Instant Payments Innovation Lab, sign up for a controlled pilot, etc.

Reach out to Deloitte at usrtppractice@deloitte.com to schedule a business discussion