Stablecoins for Faster Payments

FPC Digital Assets Work Group

This FPC Digital Assets in the Financial Industry Work Group blog aims to provide an overview of how stablecoins can enable faster and more efficient payments with a focus on meaningful topics for banks and other financial services companies. The blog will touch on specific examples of areas where traditional financial service organizations and fintech solution providers can begin to plan for the use of stablecoins as a service offering.

Part 1: The Landscape

Stablecoins, digital assets pegged to the value of another asset (the U.S. dollar in this case), are central to modernizing payment systems under the U.S. Path to Faster Payments initiative[1], which aims to increase speed and efficiency of transactions. The initiative refers to a set of industry-wide efforts to modernize the country’s payments infrastructure, enabling instant, secure, and ubiquitous payments. These efforts have been driven by The Federal Reserve, The Clearing House, and industry stakeholders like the U.S. Faster Payments Council,[2] aiming to enhance speed, efficiency, and accessibility in domestic transactions. The initiative includes multiple real-time and near-real-time payment systems, regulatory frameworks, and collaborative industry efforts.

Why Stablecoins?

Since the advent of bitcoin in 2009, the financial services industry has been actively exploring how blockchain technology can enhance or disrupt traditional payment systems that facilitate money movement around the world. In recent years, the mainstream emergence of stablecoins that are pegged to major currencies has prompted the payments industry to consider how entrenched payment methods could be challenged by this innovative technology offering a low-cost alternative with instant settlement.

By combining the speed and transparency of blockchain technology with the stability of traditional currencies, stablecoins can address some of the key challenges faced by existing payment systems.

Stablecoins offer the potential for increased transparency and traceability while also ensuring privacy and security. Because all transactions are recorded on a ledger visible to all stakeholders, they can be easily audited and verified. This can help to reduce fraud and increase trust in payments systems, while also providing valuable real-time data for users and regulators.

A primary benefit of stablecoins is their ability to enable instant 24*7 settlement at low cost including weekends and holidays. This can lead to significant cost savings, as well as improved cash flow that frees up trapped liquidity for businesses and individuals.

In recent years, many countries have unveiled new real-time payment rails to keep pace with innovation. While these new payment methods are a welcome and long overdue advancement, many have faced challenges to widespread adoption including high fees, complexity, capped payment amounts, interbank settlement and liquidity risks, and confinement to a single location.

Another key use case of stablecoins is their ability to streamline cross-border payments by reducing the complexity, cost, and time associated with international transactions that today rely on layers of intermediaries in different time zones. This can be particularly beneficial for businesses that operate in multiple locations and individuals who need to send money overseas, especially in markets with limited access to USD.

Types of Stablecoins

In the context of enabling faster payments, it is important to highlight both non-bank issued stablecoins like Tether USDT and Circle USDC and bank-issued deposit tokens because they represent two distinct approaches to digitizing cash, each with specific advantages for payments. Non-bank issued stablecoins leverage public blockchains for global distribution and ease of access, while bank-issued deposit tokens offer regulatory clarity for institutional users and integration with traditional banking and regulatory compliant systems. Recognizing both types allows users to evaluate which solution best fits their needs, whether prioritizing speed and accessibility or compliance and institutional trust.

Stablecoins: A type of digital asset whose value is pegged or tied to another asset (or basket of assets), with the aim to provide a stable store of value and mechanism of exchange.

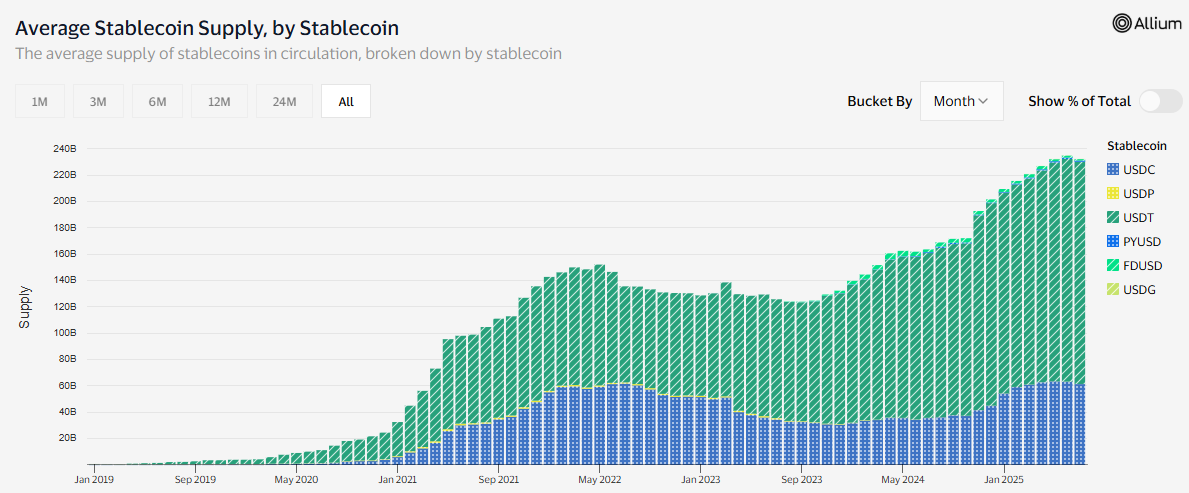

Non-bank issued: The largest circulating stablecoins that are fully collateralized by fiat currency and cash-like instruments.[3] These “public blockchain” stablecoins can allow for direct payment between business, individuals, merchants, and others over public, permissionless blockchains outside of existing payment rails. The following diagram shows how USDC and USDT currently have the largest shares by far of the stablecoin market which has several new up and coming competitors. Non-bank issuers can take different approaches to oversight and regulation. USDC, PayPal’s PYUSD, and Ripple’s RLUSD are examples of stablecoins that are subject to stringent regulatory oversight and have regular, audited reports published on their reserves.

Source[4]

Tokenized deposits: A type of bank-issued stablecoin on a bank-operated private, permissioned blockchain that is fully collateralized by a corresponding commercial bank deposit. They represent a claim on the bank like a traditional bank deposit and can be transferred between verified users without the need for traditional clearing services from intermediaries. They are designed to maintain the features of regular bank liabilities including deposit insurance. Examples include USDF Consortium, JPM Coin, and Citi’s recently announced Token Services.

Part 2: The Role of Financial Institutions and Other Payment Providers

For stablecoins to achieve mainstream adoption, financial institutions must play a critical role in bridging the gap between digital and traditional fiat currencies. As the world’s major currencies currently lack established Central Bank Digital Currencies (CBDCs) or have bans in place (as in the U.S.), FIs must consider how to innovate to provide seamless on/off ramps between stablecoins and fiat, ensuring that end beneficiaries can access their cash instantly.

Financial institutions are uniquely positioned to solve this problem by acting as trusted intermediaries, by providing the infrastructure to convert stablecoins into cash and vice versa. One potential solution might involve integrating with established instant payment rails like The Clearing House’s RTP® Network and the Federal Reserve’s FedNow® Service in the United States, the Faster Payments Service (FPS) in the United Kingdom, and the New Payments Platform (NPP) in Australia to ensure instant settlement and cash availability for end recipients.

For example, when a stablecoin payment is received, the bank can instantly credit the recipient’s account via the real-time fiat rails in the local domicile and currency. Financial institutions are uniquely positioned to provide this round-the-clock conversion service to solve the last mile problem through their established payments businesses and robust API tools that already connect with local payment schemes and their existing payment platform use cases. By leveraging traditional banking systems and integration with real-time payment rails, FIs can ensure that users have instant access to their funds at any time.

Financial institutions have an opportunity to build commercial success by offering services that support the use and operations of stablecoins by enhancing traditional services or extending into new areas of need. This new frontier of financial services could allow FIs to establish strong relationships with emerging high-growth companies that will leverage this nimble technology for financial success. Financial institutions can also explore stablecoin use cases which need not convert to and from existing legacy accounts and funds. This allows these stablecoins to behave like cash without having to interbank settle all transactions until someone chooses to exchange the stablecoin funds back into legacy accounts and funds.

General Banking

At a considerably basic level, stablecoin issuers and other blockchain FinTech companies require access to traditional bank accounts to manage their treasury operations and cashflows, make payments to employees and vendors, and benefit from the safety of deposit insurance.

Until recently, the unsettled regulatory environment in the United States has made it challenging for large deposit-taking institutions to provide basic banking services for stablecoin companies. As the evolving regulatory environment takes shape in 2025, the industry will keep a close eye on new legislation including the stablecoin-focused Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act and a new market structure bill for digital assets that may provide much needed clarity and guidelines to provide these critical banking services. For additional reading on this topic, please refer to the Digital Assets Work Group’s blog post Digital Asset and Stablecoin Regulation: U.S. Faster Payments are Shaping the Future.[5]

Currency Conversion

Financial institutions can build on existing payment and deposit capabilities to provide simplified user experience for clients to convert currency between fiat, private stablecoins, and bank tokenized deposits. These currency conversion services could integrate traditional checking accounts, connectivity to payment rails, and reconciliation tools with new blockchain and digital wallet capabilities to make it simple for clients to move on and off-chain in a KYC/AML/BSA environment as their compliance needs dictate.

ATM integration is another area where financial institutions could enhance or integrate existing capabilities to enable stablecoin to cash conversations at ATMs, allowing users to withdraw fiat instantly. ATM deposits could also be converted into stablecoins. This would require establishing partnerships with stablecoin issuers and upgrades to ATM networks and software.

Digital Wallets

Financial institutions could provide seamless access to custodial digital wallets that offer default capabilities to transfer instantly between non-bank issued stablecoins and bank-issued tokenized deposits, with built-in integration with online and mobile banking applications. This could simplify the currency conversion process and increase the utility of holding stablecoins by providing access to features like 24/7 cash sweeps, tokenized security settlement, on-chain repo facilities, and all types of digital wallet payment use cases currently done through legacy accounts and funds. For additional reading on this topic, please see the Digital Asset Work Group’s Digital Wallet in Support of Digital Assets for Instant Payments Blog.[6]

Infrastructure Services

As with traditional financial services, stablecoin users will expect the blockchain and smart contract infrastructure to operate smoothly and consistently behind the scenes. Stablecoin issuers will have an opportunity and obligation to build and manage the critical infrastructure while ensuring security, compliance, and interoperability.

Whether operating on public blockchains or private, permissioned networks, expertise in the necessary hardware and software capabilities will be essential. This will include node operation, smart contract administration, and essential security measures. Procedures and controls for token lifecycle management, including minting and burning of tokens, along with real-time reconciliation to reserves and traditional cash ledgers, will be subject to enhanced scrutiny. Financial institutions must build core competencies in these functions or look to partner with Fintechs and technology provided that have developed the required expertise.

Blockchain connectivity and interoperability will be essential to increase the utility of holding stablecoins and limit fragmentation of liquidity. Financial institutions could leverage their participation in consortium blockchain networks, embed digital identity for KYC and AML, provide universal wallets, and operate compliance gateways to transfer assets between public and private networks to provide strong and flexible user experiences.

Custodial Role

The custodial role of stablecoin reserves is a natural one for any financial institution. U.S. regulations are looking at 1:1 reserve requirement for stablecoins for both bank and non-bank issuers. Bills currently in progress have specified applicable regulatory policies over bank and non-bank stablecoin issuers. The GENIUS Act defines payment stablecoins as digital assets for payment or settlement, pegged to a fixed value, requiring 1:1 reserves and prohibiting algorithmic stablecoins. It ensures they are not classified as securities, with federal oversight for issuers above $10 billion and state regulation for smaller ones. It also mandates monthly reserve audits and AML/KYC/BSA compliance.

Financial institutions use their customer deposits for lending, based on the fractional reserve requirements for their customer deposits. They may want to only tokenize stablecoins based on customer deposits at the time when the customers want to use them for payment transactions, and only for the amount used for these payments. This differs from having to prefund RTP accounts and Federal

Instant payment rails can be used for real-time on-ramp issuance and real-time off-ramp redemption of the tokenized amounts. Financial institutions can earn interest on their issued tokenized funds held in their Fed account. Additionally, they can consider lending their own in-house tokenized funds, as a means of funding loans

The bank custody of stablecoin reserves will closely resemble the services provided for large money market funds, with banks earning basis point denominated custodial fees. Pending the final rules of new legislation, reserves will include a required minimum ratio of cash and cash-like instruments to meet short-term liquidity and redemption needs, along with investments in short duration Treasuries and Treasury repo to generate yield for the issuer. Guidelines for transparency and reporting will ensure that banks and issuers adhere to the defined industry standards.

Oversight Entity

The role of an oversight entity for stablecoins, at least for bank-issued tokens, entails managing the ecosystem to only those with applicable regulatory licensing. This includes access to the private permissioned network, rules for use, applicable types of limits, uses, and other standard compliance requirements (e.g., KYC, AML and BSA). The ecosystem can include both bank and non-bank issuers or these could be split off and then enabled to be interoperable across ecosystems. The ecosystem can also include bank and non-bank wallet custody operators which are not issuers. Applicable varied regulations and oversight can vary for each of these differ types of ecosystem operators.

Alternatively, financial institutions may choose to leverage a Fed Joint Account to hold reserves for all tokens in circulation, providing these benefits:

- Ultimate security of funds, even if the token issuer fails (e.g., bank run) and is removed from the ecosystem.

- Elimination of inter-bank settlement for token redemptions.

- Allocation of joint account interest proportionally to the token issuers and possibly shares some of that interest to ecosystem network participants that are just wallet account custodians over the tokenized funds in customer wallets.

Most global banks have established agent and correspondent banking networks that could be used to facilitate stablecoin to fiat conversations through bi-lateral contractual agreements to reach more countries.

Furthermore, financial institutions play a crucial role in integrating stablecoins with traditional fiat payment systems, especially real-time systems. This integration is vital in international payments, where banks must coordinate to expedite transactions, enhance transparency, and reduce costs. Hedging foreign currency transactions for spreads enables FX revenue opportunities for FIs.

Given the varying payment systems and differing stages of stablecoin and CBDC development across countries, a standardized connector is needed to integrate various digital currencies. For example, international banking cooperative, the Society for Worldwide Interbank Financial Telecommunication (Swift), has been leading pilots to assess such a utility for a future where traditional correspondent banking is supplemented by blockchain-based approaches. Some Fintech and crypto-native companies such as Circle, Ripple, Bridge, and BVNK are also building global networks to support stablecoin payments and offramps.

Key Points and Takeaways

Stablecoins are poised to revolutionize payments. They offer speed, efficiency, and global reach. Their integration into banking systems brings both transformative opportunities and notable risks. A strategic starting point for FIs is likely to begin with private tokenized deposits and custodial roles—managing reserves or overseeing ecosystems—before supporting public stablecoins, balancing innovation with regulatory comfort.

Until they achieve full mainstream adoption, stablecoins will rely on financial institutions to provide the traditional financial controls of the on/off-ramps for seamless fiat conversion. Financial institutions bridging stablecoins with real-time rails (e.g., RTP, FedNow) and cross-border systems will remain pivotal, potentially extending currency conversion capabilities to digital assets.

Financial institutions can capitalize on stablecoins through custody, net interest margins, transaction fees, and interoperable solutions like a stablecoin clearing house to drive innovation. These revenue streams, spanning general banking to equity stakes, position FIs as leaders in real-time international payments while reducing processing costs.

The FPC Digital Assets Work Group recommends that financial institutions pilot stablecoin-to-cash solutions (e.g., ATM integrations, digital wallets), explore Fed Joint Accounts for reserve security, and join initiatives like Swift’s blockchain pilots to standardize cross-border connectivity. Simultaneously, stress-testing for bank runs and investing in KYC analytics will fortify resilience. By seizing opportunities while addressing risks, FIs can lead to the stablecoin payments revolution, transforming challenges into competitive advantages.

Acknowledgements

Digital Assets in the Financial Industry Work Group

Thank you to the members of the FPC Digital Assets Work Group (DAWG) who contributed to this blog.

Digital Assets Work Group Leadership

Avenue B Consulting, Inc. Bo Berg, Work Group Chair

BNY Kevin Barr, Work Group Vice Chair

Avenue B Consulting, Inc. Maria Arminio, Work Group Facilitator

Digital Assets Subgroup Blog Contributors

BNY Eric Peterson, Subgroup Lead

AFM Consulting LLC Aaron McPherson

Nacha Mark Dixon

Nickel Shine LLC Michael Curry

Ripple Labs James Sellick

Strategic Resource Management Inc. (SRM) Larry Pruss

Vments, Inc. Steve Wasserman

Digital Assets Overall Work Group Contributors

1st Source Bank Alison Tusing

Aptos Labs Alex Heuer

Associate Member Bron Gary

Bates Group LLC Brandi Reynolds

Metallicus Frank Mazza

Payments as a Lifeline Kirsten Trusko

PTap Advisory, LLC Peter Tapling

Serio Payments Consulting Anthony Serio, Editorial Review

The Payments Plug Jon Shepeard

Treasury Solutions Info Tech LLC Patricia Gallagher

About the Digital Assets in the Financial Industry Work Group

Maps out how digital assets relate to the financial industry, focusing specifically on payments made with digital funds – central bank digital currency (CBDC), regulated liabilities, and stablecoin.

About the U.S. Faster Payments Council

The U.S. Faster Payments Council (FPC) is an industry-led membership organization whose vision is a world-class payment system where Americans can safely and securely pay anyone, anywhere, at any time and with near-immediate funds availability. By design, the FPC encourages a diverse range of perspectives and is open to all stakeholders in the U.S. payment system. Guided by principles of fairness, inclusiveness, flexibility, and transparency, the FPC uses collaborative, problem-solving approaches to resolve the issues that are inhibiting broad faster payments adoption in this country.

[1] https://fedpaymentsimprovement.org/wp-content/uploads/faster-payments-task-force-final-report-part-two.pdf

[2] https://fasterpaymentscouncil.org/userfiles/2080/files/us-faster-payments-council-framework-11132018.pdf

[3] Non-bank issued “algorithmic stablecoins” are collateralized by linked cryptocurrencies using smart contracts that adjust the exchange rate to peg the stablecoin value to the underlying crypto assets.