U.S. Payments Players Must Build on Real-Time’s Breakthrough Year

Craig Ramsey, Head of Real-Time Payments - Banking, ACI Worldwide

Sponsored By:

We’ve become accustomed in recent years to talking of real-time payments in the U.S. in terms of its untapped mega-market potential. But, like so much else, it seems that the trend-shattering events of the previous year-and-a-bit have intervened to turn even that well-worn story on its head.

Simply put, the COVID-19 pandemic underlined once and for all the need for real-time payments in the U.S, to maximize liquidity for consumers and businesses and to accelerate the distribution of financial assistance to those that need it. As a result, the U.S. today is finally on the cusp of its long-promised real-time payments transformation.

And nowhere is this clearer than in the data and insights from our second annual Prime Time for Real-Time report, produced in collaboration with GlobalData.

Insights from ACI and GlobalData’s 2021 Prime Time for Real-Time report

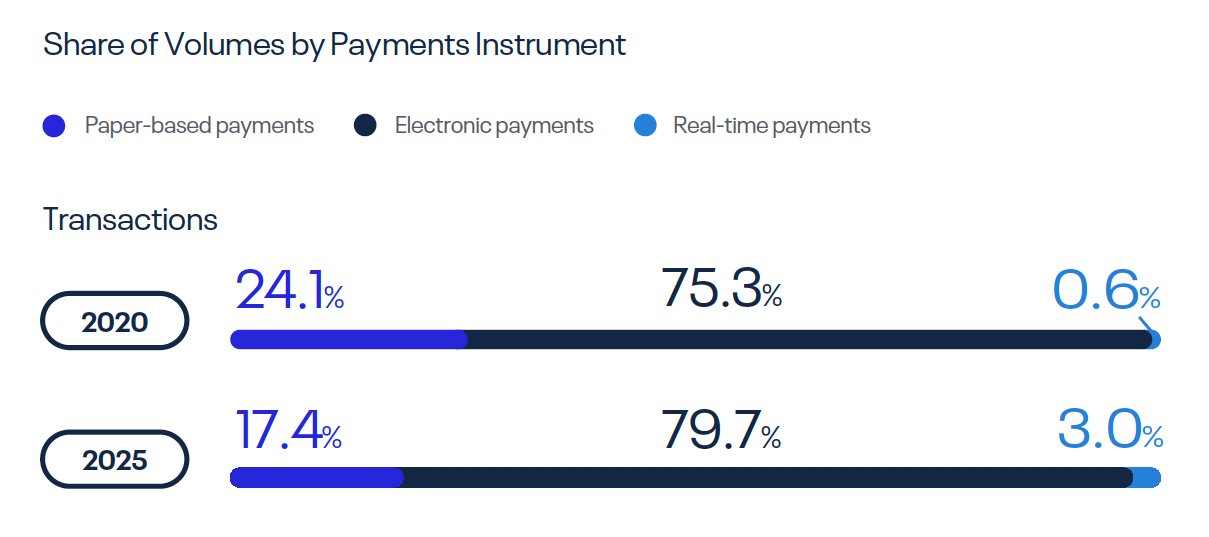

Influenced by the COVID-19 pandemic, 2020 saw real-time payments volumes hit levels higher than originally forecast. At the time of research in 2020, U.S. real-time payment transactions for 2020 were forecast to close out the year at 1.2 billion, representing 0.6% of all transactions (up from 0.3% in 2019). However, 2020 saw a late surge, with Zelle themselves reporting 1.2 billion transactions for its service alone.

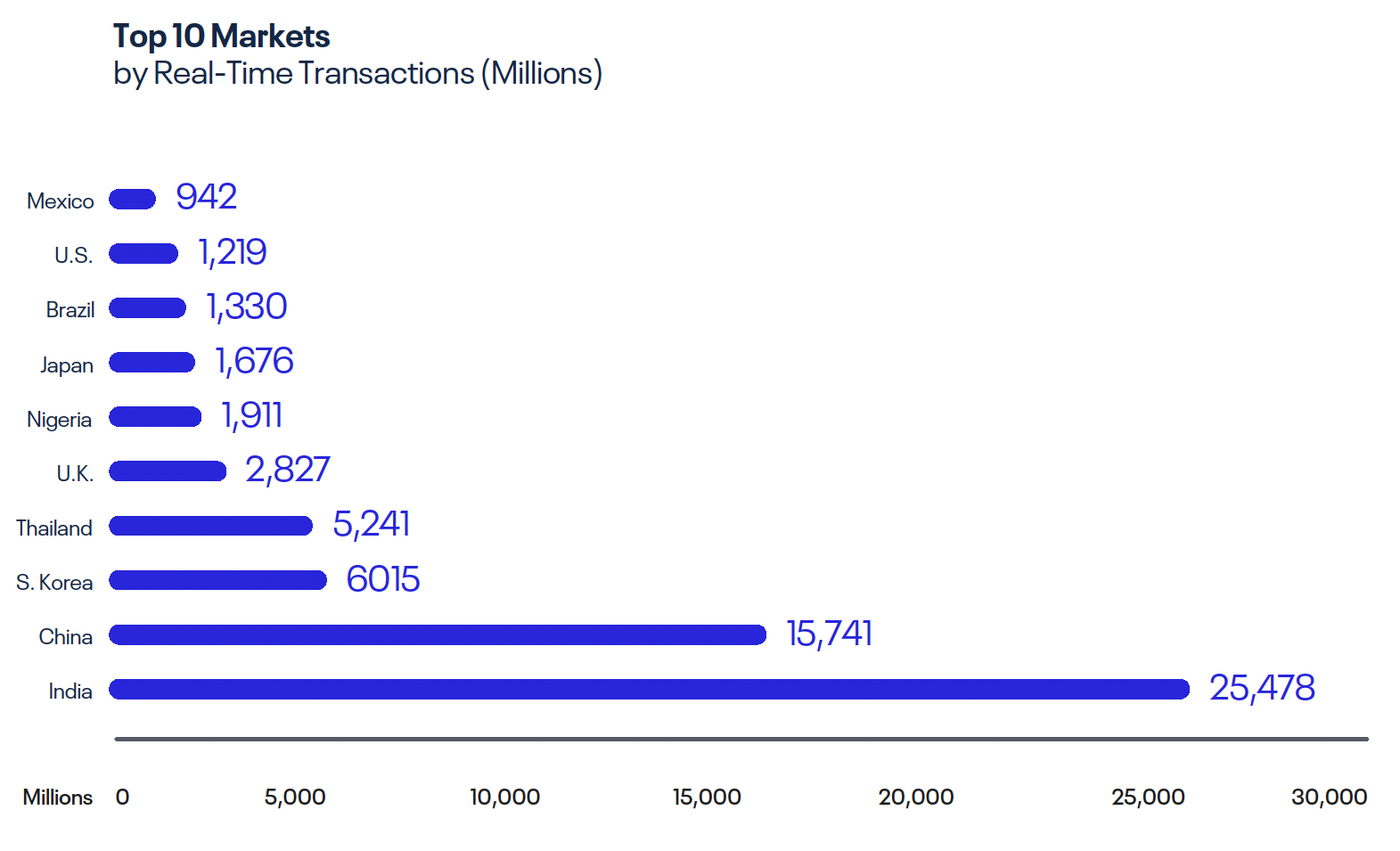

Sure, those numbers are still small compared to other payment methods. And in the global context they’re only enough for the U.S. to sneak into the top ten, behind several countries with far smaller populations. (See graph).

However, a doubling of real-time payments’ share of all transactions is a very high rate of growth indeed. And this was coupled with a key indicator of real-time success: the rising proportion of adults who have a mobile wallet and have used it in the past year. This has grown from roughly three in ten (32%) in 2019 to four in ten (41%) in 2020) in the U.S. All together it paints the picture of breakthrough in real-time payments’ penetration of the U.S market. The rapid adoption of digital wallets demonstrates a behavior change for the U.S. population, and provides a foundation for further shifts away from paper-based experiences into digital payments. As seen around the world, mobile wallet adoption often precedes real-time payments growth which comes as a fast follower to a digitally demanding customer base.

This direction of travel adds up to a strong outlook in the mid-term, with our five-year forecasts expecting annual real-time transactions to reach 7.4 billion by 2025. That is a compound annual growth rate of 43.4%, which will propel real-time payments to 3% of all transactions.

That—finally—is the kind of impressive growth that the market’s boosters have been anticipating for years. And, for those prepared to take the opportunities on offer, it is just the start.

Where (and for who) are the biggest opportunities in the U.S. real-time payments market?

Other markets that have been on this journey already provide instructive examples for how real-time payments in the U.S. could play out from here—and who the winners will be. Primarily, and almost without exception, it is low-value consumer payments to merchants that encourage the highest volumes, as evidenced by their existence in nine out of the top ten largest real-time payments ecosystems covered in our report: India, China, Thailand, United Kingdom, Nigeria, Japan, Brazil, United States and Mexico. Although many schemes launch with a P2P offering, it is delivering new services in the consumer purchasing space that drives volume and leads to merchant adoption and use cases.

And indeed, merchants in the U.S. have a range of needs that—with the right approach—acquirer companies could activate to win big with real-time payments. Their customers increasingly expect them to accept a diverse range of payments, particularly in the age of COVID-19. And they would welcome the chance to improve cash flow and liquidity while reducing the impact of interchange fees. This margin improvement can also be created in the huge (and largely untransformed) billing space, with the right services built as digital overlay services such as Request for Payment.

Inertia prevails for now, while the status quo’s current winners figure out their place in the new future (and regulators remain on the sidelines). But those acquirer companies wise enough to move early with modernization projects would have the market at their mercy, providing merchants with the best possible digital payments experiences at the fairest prices.

The winds of change are there for acquirers to take advantage of now. Reviving the use of QR codes is coming into discussions, partially because of the COVID-19 impact. And ISO 20022 will continue to be part of the story, advancing systems to better utilize the latest messaging standard and capitalize on the advanced data it generates to aid reconciliation of transactions

Banks should re-enter the real-time payments fray

Elsewhere, banks that might not have thought themselves ready to be involved in current discussions around real-time payments, or those who developed their original connectivity and services based on low volumes now have serious cause to reconsider.

Given the sudden demand for more diverse and responsive digital payments methods, ubiquity and interoperability discussions will develop from mere curiosity into more realistic conversations. And banks must play a leading role here. That’s especially true as FedNow releases more details on specifications and launches its pilot program, and as TCH’s RTP collaboration with Zelle shows strong adoption traction through large merchants and corporates (e.g., PayChex), and small banks.

The headline here will no longer be whether banks should implement real-time payments but rather how they can make the most of their real-time payments implementation. In our view they should start by revisiting consumer use cases.

PSP offerings such as Venmo have proven out demand for real-time experiences, but are they the ones best placed to perfect the business model? We would suggest not—as they test strategies for monetizing their user base, their options are ultimately limited without true real-time A2A payments underpinning the offering.

Banks are better positioned to capitalize on the benefits of real-time payments and deliver them to their customers. They have richer product portfolios and greater scale than fintech counterparts. And for most U.S. consumers, their bank is their most trusted financial institution. They would welcome a real-time P2P solution that gave them control of their money and the perceived extra layer of safety that comes from being a bank-operated service. As they became familiar and comfortable with bank-provided real-time payments from their account, they will become more amenable to additional services overlayed onto the real-time rails.

No more playing catch-up on real-time payments

The U.S. is no longer just playing catch up on real-time payments. The speed at which consumers and businesses switched to digital payment preferences in 2020 shows that the final grip of cash (and even checks) on the market has been broken. It is now gearing up to become a global powerhouse.

There has never been a more opportune moment for banks to win customers with new value-added services that ride the real-time rails. And acquirers stand to win huge market share as merchants seek the best possible digital payment experiences for customers online and at the point of sale.

As such, U.S. banks and acquirers need to start making sustained efforts to get out ahead now. Modern, rich data systems that support alternative and real-time payments are a must. That means developing payments modernization strategies and revenue models that leverage—rather than resist—real-time’s strengths: lower fees and, if handled well, better and stickier customer experiences.