The Imperative of Digital Identity for Financial Institutions

FPC Digital Assets Work Group

The year 2025 has been a transformative period for faster payment technology, with AI, agentic payments, and stablecoins revolutionizing transactions and enabling seamless international digital asset transfers. These rapid advancements are reshaping the financial landscape at an unprecedented pace, opening new business opportunities while also presenting emerging risks that financial institutions (FIs) must address. The evolution places a heightened responsibility on FIs to implement robust solutions to combat fraud and meet the challenges of instant global commerce.

Historically, institutions acknowledged their role in fraud prevention, with about half adopting new technology controls for faster payments as early as 2022.[1] The latest technological leap now demands even greater responsibility and innovative solutions to protect transactions and ensure security. Complementary protective measures are essential, especially as digital identity solutions are projected to reach five billion people, enhancing security and efficiency for digital interactions.[2]

Digital identity, which involves trusted digital credentials verified through biometrics and personal attributes, is key to securing digital transactions. In this blog, the FPC Digital Assets Work Group offers guidance for FIs on assessing and implementing digital identity solutions that meet strategic goals, reduce fraud, and improve client satisfaction in this evolving digital payments landscape.

Viewing the Current State through the Identity Lifecycle

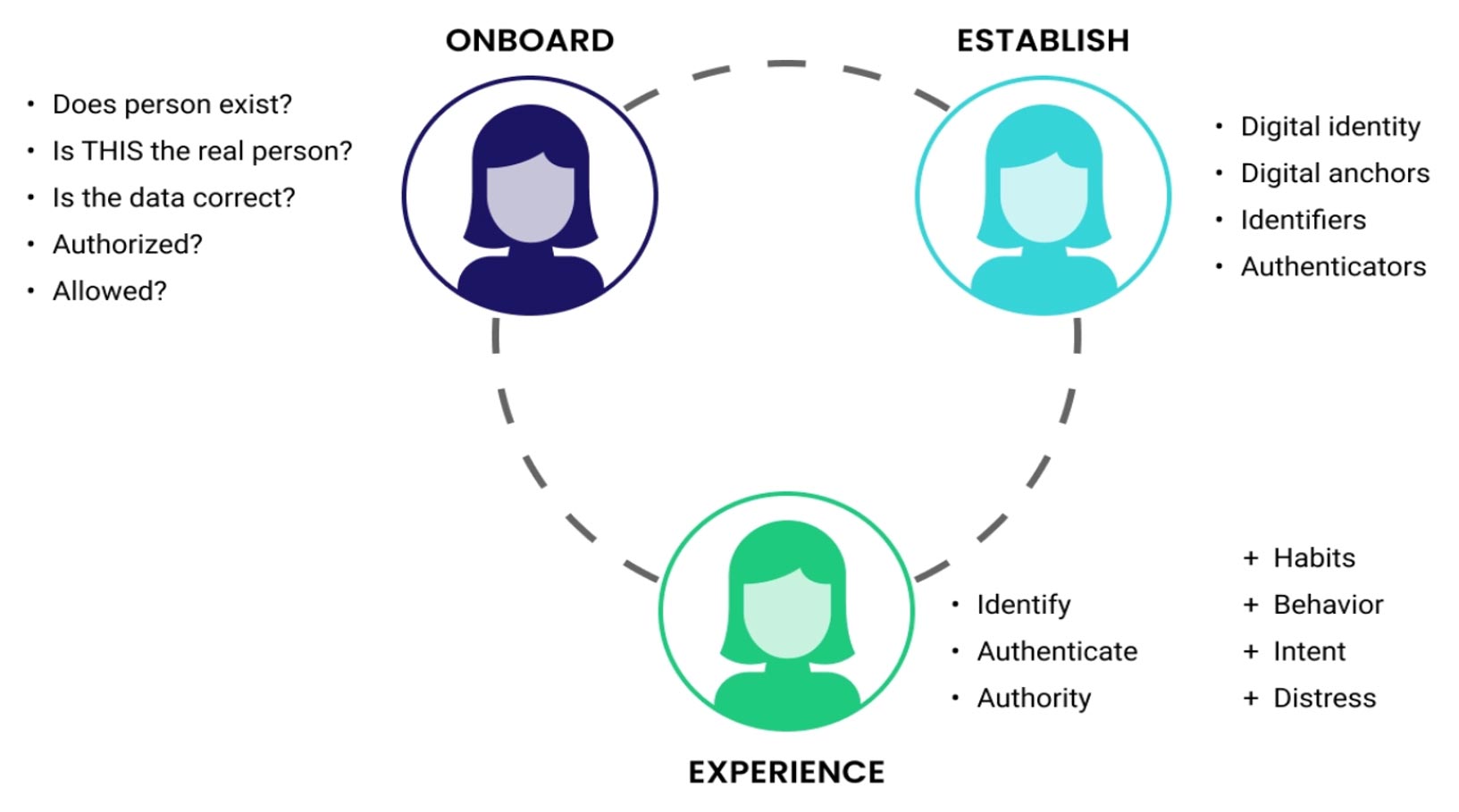

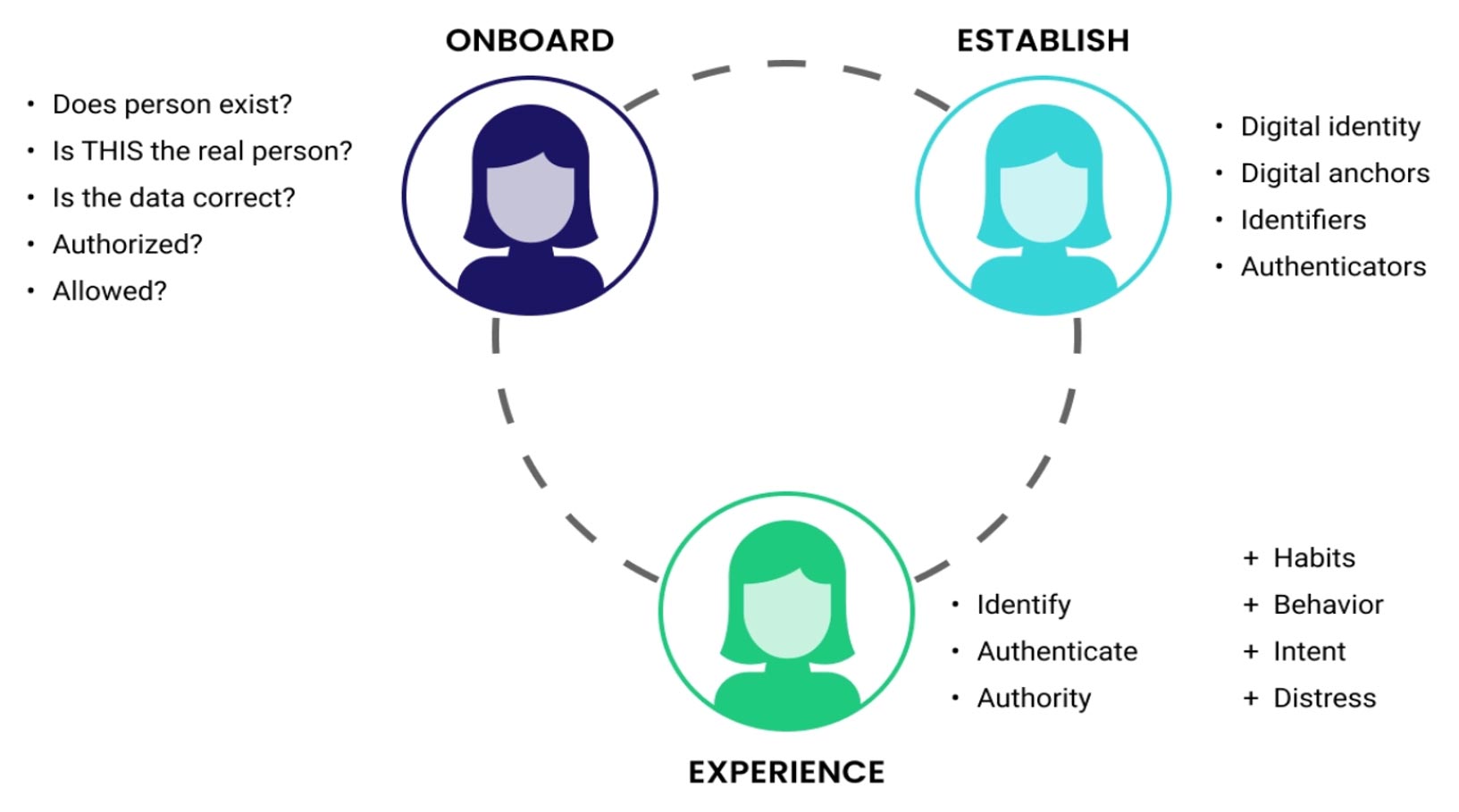

Identity solutions have continuously evolved to keep pace with global regulatory, compliance, and technology standards that aim to prevent fraudulent use of the financial system. While some solutions can be more technical in nature than others, all can be easily reviewed and assessed in their application across three identity stages: Onboard, Establish, and Experience.

![]()

During the Onboard stage, financial institutions begin by verifying whether a client or legal entity exists, confirming that the individuals are who they claim to be, validating accuracy of the information provided, and ensuring that the individual is authorized to act in the stated capacity.

In the Establish stage, a social identity is bound to an entity that exists and is valid, and a digital credential to represent that identity is established. Financial Institutions assign unique identifiers to clients, but these are generally not interoperable across products, platforms, or peer institutions. Therefore, most identity associations are primarily bound to a single provider and result in fragmentation and friction in overall customer experience.

The Experience stage, where authenticated clients initiate transactions, encounters additional inefficiencies, such as authentication and transaction authorization which are typically handled through static access controls and varied device-dependent methods.

As a result, financial institutions face significant pain points at each stage of the lifecycle. These issues contribute to higher operational costs, increased fraud exposure, and poor client experience, highlighting the need for scalable and modern digital identity solutions.

Identity Lifecycle Challenges and Impact

Evaluating New Digital Identity Solutions

Blockchain technology and cryptographically secured identity for instant payments can seem highly complex and difficult for business leaders to navigate. Yet behind the technical jargon lies a set of practical tools designed to solve real-world challenges that can help to reduce fraud, streamline authentication, and build trust at scale.

By translating the blockchain model regarding each stage, FIs can evaluate new digital identity solutions in a consistent context. The FPC Digital Assets Work Group provides descriptions of some of the emerging solutions that will have a positive impact on the strategic priorities faced by financial institutions including, but not limited, to those identified in the FPC’s Faster Payments Fraud Trends and Mitigation Opportunities.[3]

Onboard Stage: Generating account access and performing verification of credentials

Solutions are used to verify a variety of requirements for generating an account on a system.

Solutions work together to associate and authenticate an account and its digital identity credentials.

Solutions collectively enable frictionless interactions against a myriad of security challenges.

Building Digital Identity Strategy from the Lifecycle Stages

While digital identity is just one component of a FIs overall payment strategy, it is increasingly important to both mitigate fraud and enable a seamless customer experience in a world of instant transactions. The Digital Identity Lifecycle Stages provide a point-of-departure for financial organizations to target the areas – Onboarding, Establish or Experience – that demand the most critical attention. Once focus areas are established and solutions are properly weighed against tradeoffs, the successful implementation of any solution requires 360-degree planning to assess how it can replace, enhance, or extend capabilities in all lifecycle stages.

Given the surface area of risk, speed of technology changes, and level of ongoing account support that needs to be maintained, it is difficult (if not improbable) to find a single identity solution for a “one-and-done, one-size-fits-all” digital identity reset. FIs will ultimately require multiple targeted improvements to get their digital identity capabilities to meet and exceed their strategic objectives. To establish a consistent standard for evaluation, business leaders can fall back on this lifecycle model to guide their own strategic execution, from issue prioritization and solution exploration to system integration and implementation.

FI leaders are encouraged to regularly assess emerging identity solutions throughout the year, aligning them with their strategic priorities as new opportunities and challenges arise. To ensure a selected solution is effective, implementation should only occur when lifecycle planning verifies that benefits and risks are well understood and fit for purpose.

Acknowledgements

Digital Assets in the Financial Industry Work Group

Thank you to the members of the FPC Digital Assets Work Group (DAWG) who contributed to this blog.

Digital Assets Work Group Leadership

Avenue B Consulting, Inc. Bo Berg (Chair)

BNY Kevin Barr (Vice Chair)

Avenue B Consulting, Inc. Maria Arminio (WG Facilitator)

DAWG Blog Main Authors

DAWG Additional Members & Contributors

About the Digital Assets in the Financial Industry Work Group

Maps out how digital assets relate to the financial industry, focusing specifically on payments made with digital funds – central bank digital currency (CBDC), regulated liabilities, and stablecoin.

About the U.S. Faster Payments Council

The U.S. Faster Payments Council (FPC) is an industry-led membership organization whose vision is a world-class payment system where Americans can safely and securely pay anyone, anywhere, at any time and with near-immediate funds availability. By design, the FPC encourages a diverse range of perspectives and is open to all stakeholders in the U.S. payment system. Guided by principles of fairness, inclusiveness, flexibility, and transparency, the FPC uses collaborative, problem-solving approaches to resolve the issues that are inhibiting broad faster payments adoption in this country.

Historically, institutions acknowledged their role in fraud prevention, with about half adopting new technology controls for faster payments as early as 2022.[1] The latest technological leap now demands even greater responsibility and innovative solutions to protect transactions and ensure security. Complementary protective measures are essential, especially as digital identity solutions are projected to reach five billion people, enhancing security and efficiency for digital interactions.[2]

Digital identity, which involves trusted digital credentials verified through biometrics and personal attributes, is key to securing digital transactions. In this blog, the FPC Digital Assets Work Group offers guidance for FIs on assessing and implementing digital identity solutions that meet strategic goals, reduce fraud, and improve client satisfaction in this evolving digital payments landscape.

Viewing the Current State through the Identity Lifecycle

Identity solutions have continuously evolved to keep pace with global regulatory, compliance, and technology standards that aim to prevent fraudulent use of the financial system. While some solutions can be more technical in nature than others, all can be easily reviewed and assessed in their application across three identity stages: Onboard, Establish, and Experience.

Source: Diagram provided by PTap Advisory as published in https://www.outseer.com/blog/protecting-payments-is-expanding-the-identity-life-cycle

During the Onboard stage, financial institutions begin by verifying whether a client or legal entity exists, confirming that the individuals are who they claim to be, validating accuracy of the information provided, and ensuring that the individual is authorized to act in the stated capacity.

In the Establish stage, a social identity is bound to an entity that exists and is valid, and a digital credential to represent that identity is established. Financial Institutions assign unique identifiers to clients, but these are generally not interoperable across products, platforms, or peer institutions. Therefore, most identity associations are primarily bound to a single provider and result in fragmentation and friction in overall customer experience.

The Experience stage, where authenticated clients initiate transactions, encounters additional inefficiencies, such as authentication and transaction authorization which are typically handled through static access controls and varied device-dependent methods.

As a result, financial institutions face significant pain points at each stage of the lifecycle. These issues contribute to higher operational costs, increased fraud exposure, and poor client experience, highlighting the need for scalable and modern digital identity solutions.

Identity Lifecycle Challenges and Impact

| Customer Identity Lifecycle Stage | Key Challenges | Impact on Institutions | Impact on Customers |

| Onboard | Tedious, complex account creation Slow, repetitive KYC High false positives Manual checks Difficulty verifying if a client or legal entity exists Confirming identity and authority |

Lost customer acquisition Increased operational costs Compliance burden Reputational damage |

Frustration & churn Delayed access to services Poor initial experience |

| Establish | Outdated static customer due diligence (CDD) Outdated monitoring rules Identity associations are still primarily bound to a single provider Non-interoperable identifiers, causing fragmentation |

Increased financial crime risk Substantial fines & remediation orders Missed Suspicious Activity Reports (SAR) |

Loss of trust Delayed transactions Inconvenience from false alerts |

| Experience | Inefficiencies in authentication Static access controls Device dependency Fraud risks (deepfakes, account takeovers) Fragmented credential management |

Significant financial losses (tens of billions at risk) Compromised system integrity Reputational damage |

Loss of funds Identity theft Erosion of trust in digital interactions |

Evaluating New Digital Identity Solutions

Blockchain technology and cryptographically secured identity for instant payments can seem highly complex and difficult for business leaders to navigate. Yet behind the technical jargon lies a set of practical tools designed to solve real-world challenges that can help to reduce fraud, streamline authentication, and build trust at scale.

By translating the blockchain model regarding each stage, FIs can evaluate new digital identity solutions in a consistent context. The FPC Digital Assets Work Group provides descriptions of some of the emerging solutions that will have a positive impact on the strategic priorities faced by financial institutions including, but not limited, to those identified in the FPC’s Faster Payments Fraud Trends and Mitigation Opportunities.[3]

Onboard Stage: Generating account access and performing verification of credentials

Solutions are used to verify a variety of requirements for generating an account on a system.

| Solutions |

Application |

| Blockchain | Decentralized, tamper-proof ledgers to securely store and manage identity records, minimizing reliance on centralized authorities and improving trust and data sharing across different platforms. |

| Verifiable Credentials | Cryptographically secured digital attestations issued by trusted authorities, allowing individuals to carry portable, privacy-preserving proofs of attributes such as age or qualifications that can be independently verified by third parties. |

| Biometrics | Secure, user-friendly means of access to unique biological traits like fingerprints or facial features to significantly reduce the risks associated with verifying humanity and individuality enhancing overall security. |

Establish Stage: Associating a Digital Identity to a generated Account

Solutions work together to associate and authenticate an account and its digital identity credentials.

| Solutions | Application |

| Decentralized Identifiers (DIDs) | After verification of credentials, DIDs represent account to associate, access, and control their digital identity independently of centralized authorities, and allowing for platform interoperability. |

| Zero-Knowledge Proofs (ZKPs) | Enhance data privacy in the custody of personal identifiable information by allowing users to prove they possess certain attributes without revealing the underlying data. For example, it is possible to verify that someone is over 17 without disclosing their actual age. |

| Self-Sovereign Identity (SSI) Wallets | Limits institutional liability by allowing users full custody and control over their digital identities. Wallets hold and administer DIDs, credentials, and personal information on user-owned devices. Note: Apple announced[4] on November 12th the addition of a feature that allows users to digitize their U.S. driver’s licenses and passports, convert them into digital IDs, and add them to Apple Wallet for presentation via iPhone or Apple Watch. |

Experience Stage: Securing Institutions & Accounts across every Interaction

Solutions collectively enable frictionless interactions against a myriad of security challenges.

| Solutions | Application |

||

| Biometric Authentication | Onboarding and associating an account with biometrics allow users to prove they are the unique entity allowed to authorize transactions frequently at low friction and high confidence. |

||

| Transaction Monitoring | Attributes associated with transactions from a given account like location, time of day, volume, frequency provide insight to investigate and rectify authorized and unauthorized fraud scenarios on seemingly valid transactions. |

||

| AI-based Fraud Detection | Use AI to detect deepfakes, social engineering, and account takeovers, strengthening ongoing security. Continuously analyzes large data sets to identify and prevent fraudulent activities, mitigating risks and enhancing organizational security. |

||

While digital identity is just one component of a FIs overall payment strategy, it is increasingly important to both mitigate fraud and enable a seamless customer experience in a world of instant transactions. The Digital Identity Lifecycle Stages provide a point-of-departure for financial organizations to target the areas – Onboarding, Establish or Experience – that demand the most critical attention. Once focus areas are established and solutions are properly weighed against tradeoffs, the successful implementation of any solution requires 360-degree planning to assess how it can replace, enhance, or extend capabilities in all lifecycle stages.

Given the surface area of risk, speed of technology changes, and level of ongoing account support that needs to be maintained, it is difficult (if not improbable) to find a single identity solution for a “one-and-done, one-size-fits-all” digital identity reset. FIs will ultimately require multiple targeted improvements to get their digital identity capabilities to meet and exceed their strategic objectives. To establish a consistent standard for evaluation, business leaders can fall back on this lifecycle model to guide their own strategic execution, from issue prioritization and solution exploration to system integration and implementation.

FI leaders are encouraged to regularly assess emerging identity solutions throughout the year, aligning them with their strategic priorities as new opportunities and challenges arise. To ensure a selected solution is effective, implementation should only occur when lifecycle planning verifies that benefits and risks are well understood and fit for purpose.

[2] https://www.juniperresearch.com/press/pressreleasesdigital-identity-app-installations-to-reach-5bn-globally/

Digital Assets in the Financial Industry Work Group

Thank you to the members of the FPC Digital Assets Work Group (DAWG) who contributed to this blog.

Digital Assets Work Group Leadership

Avenue B Consulting, Inc. Bo Berg (Chair)

BNY Kevin Barr (Vice Chair)

Avenue B Consulting, Inc. Maria Arminio (WG Facilitator)

DAWG Blog Main Authors

| Nickel Shine LLC | Michael Curry (Subgroup Lead) |

| BNY | Eric Peterson |

| FPC Member | Bronal Gary |

| Metallicus | Frank Mazza |

| Payments as a Lifeline | Kirsten Trusko |

| PTap Advisory, LLC | Peter Tapling |

| SRM | Larry Pruss |

DAWG Additional Members & Contributors

| 1st Source Bank | Alison Tusing |

| AFM Consulting LLC | Aaron McPherson |

| American Express | Sofia Freyder |

| American Express | Margaret Rae |

| Bankers’ Bank of Kansas | Daniel Hayden |

| Bates Group | Brandi Reynolds |

| BOK Financial | Clint Dishman |

| DeNovo Treasury | Diane Sherman |

| Matera | Sarah Hoisington |

| Nacha | Mark Dixon |

| PayGility Advisors | David True |

| Payments as a Lifeline | Mark Steven |

| Serio Payments Consulting | Anthony Serio (Editorial Review) |

| The Payments Plug | Jonathon Shepeard |

| Treasury Solutions Info Tech LLC | Patricia Gallagher |

| US Bank | Jaipal Arora |

| Vments, Inc. | Steve Wasserman |

About the Digital Assets in the Financial Industry Work Group

Maps out how digital assets relate to the financial industry, focusing specifically on payments made with digital funds – central bank digital currency (CBDC), regulated liabilities, and stablecoin.

About the U.S. Faster Payments Council

The U.S. Faster Payments Council (FPC) is an industry-led membership organization whose vision is a world-class payment system where Americans can safely and securely pay anyone, anywhere, at any time and with near-immediate funds availability. By design, the FPC encourages a diverse range of perspectives and is open to all stakeholders in the U.S. payment system. Guided by principles of fairness, inclusiveness, flexibility, and transparency, the FPC uses collaborative, problem-solving approaches to resolve the issues that are inhibiting broad faster payments adoption in this country.