Tokenized Deposits and the Potential for Faster Payments

FPC Digital Assets Work Group

In this blog, the FPC Digital Assets Work Group (DAWG) explores tokenized deposits, which offer the promise of significant risk reduction and automation potential to financial markets. Tokenized deposits have the potential to meaningfully drive adoption of faster payments in the U.S., particilarly on business-to-business, high-value transactions where faster payments have made little progress to-date.

What are tokenized deposits?

Tokenized deposits are a type of digital asset that represent a claim on a fiat currency deposit held by a regulated financial institution. For example, a tokenized U.S. dollar (USD) deposit would be backed by a real USD deposit in a bank account and would have the same value and legal status as the underlying currency. In short, these are deposits as individuals and institutions know and love them today. Tokenized deposits can be issued and redeemed by the financial institution that holds the fiat deposit and can be transferred and exchanged on a distributed ledger technology network.

How do tokenized deposits work?

Tokenized deposits create instantaneous clearing and settlement in the transfer of value from account / wallet A to account / wallet B, thereby de-risking transaction processing not only for financial institutions but for end-clients as well.

Tokenized deposits also create efficiencies because they can use smart contracts, which are self-executing agreements that are encoded on the blockchain and automatically enforce the terms and conditions of the transaction. A smart contract can specify the rules for issuing, redeeming, transferring, and exchanging tokenized deposits, as well as the fees, interest rates, and collateral requirements associated with a given financial arrangement. For example, a smart contract for a tokenized deposit can be linked to a smart contract for a decentralized exchange, which allows users to swap tokenized deposits for other digital assets, or vice versa, without the need for a third-party intermediary, and settle atomically (more on this, below).

Tokenized deposits exist in a highly programmable ecosystem. Currently financial institutions have to incorporate or “connect” to new payment schemes (e.g., RTP and FedNow). With tokenized deposits, the transfer of funds from wallet A to wallet B can be programmed to look like ACH, RTP, Wires or any other payment network, based on the rules of the payment scheme. This lowers adoption costs for financial institutions leveraging tokenized deposits / blockchain, and speeds delivery of value to end-clients.

New Concepts

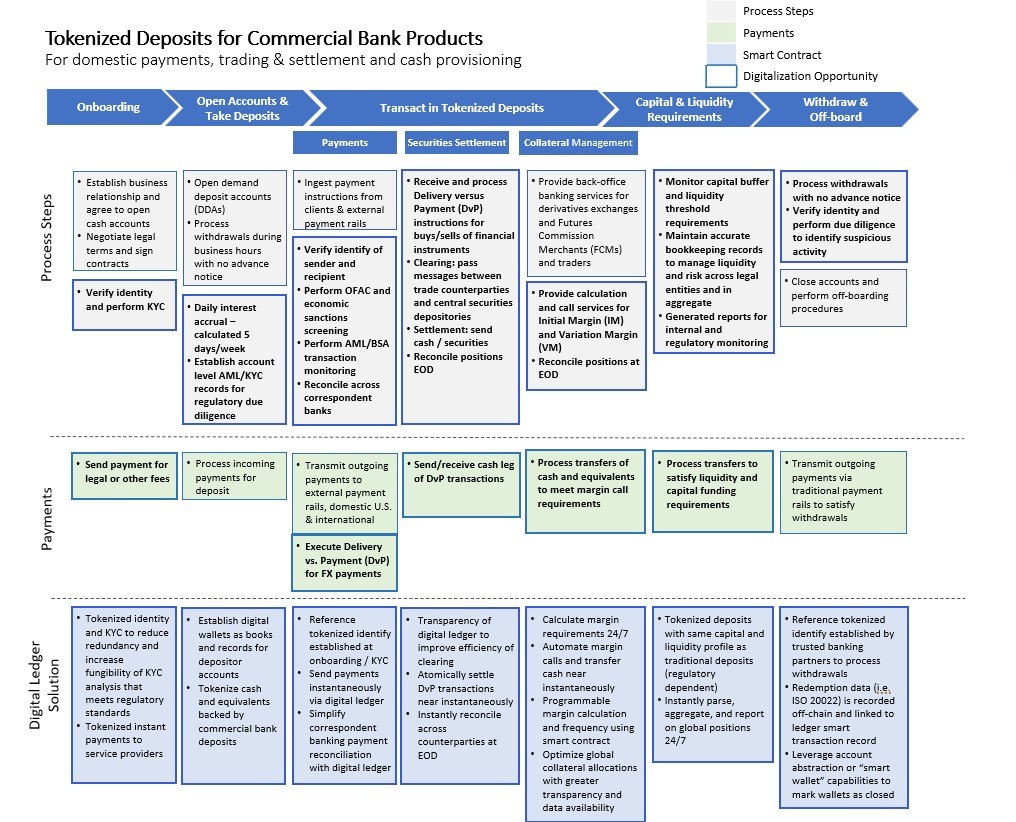

Using the digital asset template the DAWG introduced in Blog 1 FPC DAWG BLOG_01_Template Companion.pptx (live.com) provided the backdrop for evaluating how tokenized deposits can be leveraged to drive the aforementoned benefits.

The most critical part of tokenized deposits is the manner in which they facilitate transactions that exists in markets today, but also in a manner which drives additional automation with less risk for clients.

In securities or asset markets, Delivery vs. Payment (DvP) is a method by which the majority of securities are settled. This process involves trade confirmations, clearing banks, and additional risk related to operational processes, when using existing systems. With tokenized deposits, the DvP settlement becomes atomic, meaning that the transfer of securities and cash happen simultaneously. This not only reduces operational errors, but it also drives automation and the potential for elimination of clearing functions within the financial markets.

Clients may also see collateral management applications, specifically focused on margining in the near term. If the underlying trade is also done on distributed ledger technology (DLT), there would not be high hurdles to creating a smart contract for the collateral shell, which continuously and automatically transfers cash between the borrower and lender, or exchange and underlying broker-dealer (i.e., futures commission merchant).

The impact on corporate treasuries could be significant as treasuries could be highly automated with little need to focus on operational processes, and settlement timing, e.g., FX. Treasurers may instead focus on prompts from the distributed ledger technology smart contracts and spending more time on strategic decisions around capital markets activity and availability of working capital. To fully realize this future, there would need to be additional market structure changes (e.g., 24/7 money market funds availability), but the infrastructure and tokenized deposits lay the foundation for this.

What are the benefits of tokenized deposits for financial institutions?

Tokenized deposits can offer several benefits for financial institutions – reduced costs, increased efficiency, and enhanced security.

Tokenized deposits can lower the operational and transactional costs for financial institutions, as they can compress the technology stack used to support payments broadly. Tokenized deposits can also reduce the costs of compliance, as they can enable faster and more transparent reporting and auditing and facilitate the implementation of anti-money laundering (AML) and know-your-customer (KYC) regulations, because this data can come along with the transfer of deposit tokens.

Increasing the processing speed and scalability of transactions, tokenized deposits enable near instantaneous and frictionless transfers and exchanges on a DLT without the delays and errors that can occur in traditional systems. Tokenized deposits can also improve the liquidity and accessibility of funds, as they can be moved on a 24/7 basis and used across market operating hours, avoiding cutoff times and payment windows. Additional studies related to broader financial system impacts of instantaneous money movement should continue, not specific to, but including tokenized deposits.

Tokenized deposits can enhance the security and trustworthiness of transactions, as developments such as tokenized identity/ identity validation can help to reduct payment fraud on an industry wider basis.

The use of a joint account for reserves also reduces risks and eliminates the need for inter-bank settlement on every transaction to only when the tokenized funds are redeemed versus reused and recirculated within its ecosystem.

Recommendations for implementation

Tokenized deposits are a promising innovation that can offer significant benefits for financial institutions, but they also pose some challenges and risks that need to be addressed. Therefore, DAWG recommends the following steps for implementing tokenized deposits:

- Define the use case and the value proposition: Financial institutions should identify the specific problem or opportunity that tokenized deposits can solve for clients, and the expected outcomes and benefits that they can deliver. For example, tokenized deposits can be used for cross-border payments, remittances, real estate transcations, traceable trade finance, or enhanced speed of lending for purpose bound transactions.

- Select the blockchain network and the token standard: Financial institutions should choose the type of blockchain network (public or private) and the token standard (such as ERC-20, ERC-721, or ST-20) that best suit their needs and preferences, based on the criteria and trade-offs discussed above. For example, public blockchain networks can be more suitable for tokenized deposits that aim to achieve global reach, interoperability, and innovation, while private blockchain networks can be more suitable for tokenized deposits that require high performance, privacy, and compliance. An example of industry work on interoperability and settlement can be found here: (https://regulatedliabilitynetwork.org/)

- Partner with the relevant stakeholders: Financial institutions should collaborate with regulators, customers, technology providers, and other financial institutions, to ensure that tokenized deposits are compliant, secure, and interoperable. For example, financial institutions should obtain the necessary licenses and approvals from the regulators, educate, and inform customers about the benefits of tokenized deposits, and make build vs. buy decisions on the infrastructure, and cooperate with other financial institutions that issue or accept tokenized deposits, avoiding walled gardens.

- Test and iterate: Financial institutions should start with a high-value, customer driven pilot or a proof-of-concept project to test and evaluate the feasibility and viability of tokenized deposits, and to collect feedback and data from the experiment. To minimize financial and operational risks, financial institutions may also want to run the pilot in shadow mode. Based on the results and learnings, financial institutions should chart a path to migrating certain functions towards DLT infrastructure.[1]

As you will hear in upcoming blogs, tokenized deposits and cash on-chain will be critical enablers to capture the full benefits of digital assets.

Digital Assets in the Financial Industry Work Group

Thank you to the members of the FPC Digital Assets Work Group (DAWG) who contributed to this blog.

Digital Assets Work Group Leadership

Bo Berg (Work Group Chair), Avenue B Consulting, Inc.

Kevin Barr (Wok Group Vice Chair), BNY Mellon

Maria Arminio (Work Group Facilitator), Avenue B Consulting, Inc.

Digital Assets Work Group Contributors

Keith Vander Leest, Cross River Bank

Jonathan Shiery, Guidehouse

Kirsten Trusko, Payments as a Lifeline

Steve Wasserman, Photon Commerce

Lou Grilli, PSCU

Peter Tapling, PTap Advisory, LLC

Larry Pruss, Strategic Resource Management Inc. (SRM)

Robert Gallic, The MITRE Corporation

Jaipal Arora, US Bank

About the Digital Assets in the Financial Industry Work Group

Maps out how digital assets relate to the financial industry, focusing specifically on payments made with digital funds – central bank digital currency (CBDC), regulated liabilities and stablecoin.

About the U.S. Faster Payments Council

The U.S. Faster Payments Council (FPC) is an industry-led membership organization whose vision is a world-class payment system where Americans can safely and securely pay anyone, anywhere, at any time and with near-immediate funds availability. By design, the FPC encourages a diverse range of perspectives and is open to all stakeholders in the U.S. payment system. Guided by principles of fairness, inclusiveness, flexibility, and transparency, the FPC uses collaborative, problem-solving approaches to resolve the issues that are inhibiting broad faster payments adoption in this country.