Digital Assets in the Financial Industry

FPC Digital Assets Work Group

The Faster Payment Council (FPC) Digital Assets Work Group is proud to present the first of a series of blogs that map out how digital assets relate to the financial services industry, focusing specifically on payments made with digital funds.

A digital asset is the broad term used to describe any value that is stored digitally, is uniquely identifiable that organizations or individuals can use to realize value, and which is recorded on a cryptographically secured distributed ledger. As part of this continuing education process, the Work Group defined basic terms related to digital assets, which have been added to the FPC glossary at https://fasterpaymentscouncil.org/Glossary-of-Terms.

This series of blogs is designed to address the most topical issues relating to the use of digital assets in support of faster payments in the U.S., including how faster payments can facilitate purchases or payments made using digital assets and the timing expectations. The role of the distributed ledger technology is fundamental to this discussion and thus the point of departure for this first blog.

Thoughts on Digital Assets and What It Means for Faster Payments

The FPC Digital Assets Work Group has been tasked with providing guidance to the industry on the emerging use of digital assets and digital cash in light of the FPC’s focus on faster payments in the U.S. As stated in the charter, the Work Group bounded the discussion on digital assets to the movement and storage of those assets that use faster payments to purchase or pay with regulated (i.e., non-crypto) digital funds. The movement and storage of digital assets is facilitated using distributed ledger technology (DLT), defined as technology that uses a consensus of replicated, shared, and synchronized digital data geographically spread across multiple sites, countries or institutions with no central administrator or centralized data storage.

In this blog, the Work Group set out to map the major steps supporting digital assets using distributed ledger technology as the fundamental building block for faster payments. The Work Group started by identifying the classifications of digital assets; the short list of commercial bank products included (but was not limited to) Mortgage Processing, Trade Finance, Equities, Tokenized Deposits and Currency Conversion.

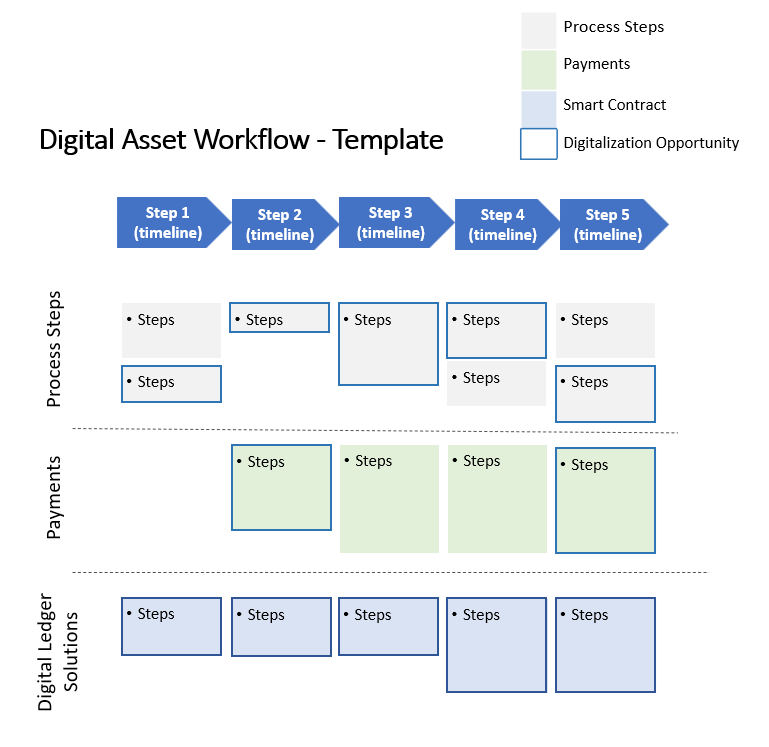

The Work Group examined a few use cases for these commercial bank products to: (1) determine the process flows for any given use case, (2) identify where payments are facilitated in each step, and (3) pinpoint those processes that might be supported by DLT - using the Digital Asset Workflow Template to standardize the approach.

Note: A downloadable version of this PowerPoint template is available for your organization’s workflow planning.

Once process flows had been sketched, a few insights quickly became evident. First, it was clear that the use of the technology could more easily automate processes, which reduced the time needed to complete a task, and ultimately made for a better and more streamlined customer experience. While automating manual tasks is a good place to start, integrating effective identity and access management early on can have the greatest long-run impact by accelerating transaction processing times. Keep in mind, those initiatives are not singularly an issue for digital assets but apply to transaction processing across multiple use cases and applications, though use of tokenization certainly has shown promising capabilities in this space.

The application of faster payments based on real-time authorization, clearing and settlement is readily available using existing U.S. payment rails, namely RTP® and FedNow®. However, some firms may struggle with the challenge of integrating new technologies with existing legacy tech stacks (let alone getting them prioritized in full development queues). Suffice it to say that simply supporting faster payments for traditional fiat currency is not a huge industry challenge, however adoption of these rails still has room to grow, and when incorporating DLT into the tech stack, there will be some issues in data exchange and instantaneous vs. batch processes, at least until further standardization is in place. Thus, the payment aspect for digital assets does not pose an insurmountable impediment to adoption, though is not without its challenges.

This brings us to the burning question – “How does the financial services industry pivot to the use of distributed ledger technology to support faster payments?” Using DLT as core infrastructure may be on the roadmap for certain financial institutions. The use of distributed ledger technology for the on-chain storage and trading of digital assets (image and metadata) clearly supports faster processing times. However, development lags because most financial institutions are not ready to make a technological leap of that magnitude. The interim step will be to find high-value use cases to take measured steps with the technology, and likely incorporate on and off chain activities (e.g., a digital asset transaction ultimately being recorded on another file system). Forward thinking companies will use DLT in private chains for specific applications to kick-start the move to this infrastructure.

Another fundamental building block of DLT is the smart contract. Written in code and stored on the blockchain, the smart contract automatically executes, controls, or documents the events and actions in accordance with the terms of the contract or agreement. Smart contracts help to reduce transaction time and costs, as they are executed automatically on the blockchain.

Distributed ledger technology enables the exchange, buying, selling, and trading of digital assets on digital platforms.This technology reduces friction in the workflows, improves operational efficiencies and drives straight-through processing. As the FPC Digital Assets Work Group continues to explore how and where faster payment opportunities exist in support of digital assets, the heart of the challenge may lie in the timeframe in which the financial service industry will adopt DLT and blockchain technology for these purposes.

Digital Assets in the Financial Industry Work Group

Thank you to the members of the FPC Digital Assets Work Group (DAWG) who contributed to this blog.

DAWG Leadership

Bo Berg (Chair), Avenue B Consulting, Inc.

Maria Arminio (WG Facilitator), Avenue B Consulting, Inc.

Work Group Members

Keith Vander Leest, Cross River Bank

Jonathan Shiery, Guidehouse

Valerie Gorsh, Guidehouse

Steve Wasserman, Photon Commerce

Lou Grilli, PSCU

Peter Tapling, PTap Advisory, LLC

Jaipal Arora, US Bank

Michael Knorr, Wells Fargo & Company